Preparing For Retirement At Any Stage Of Life

May 9, 2025

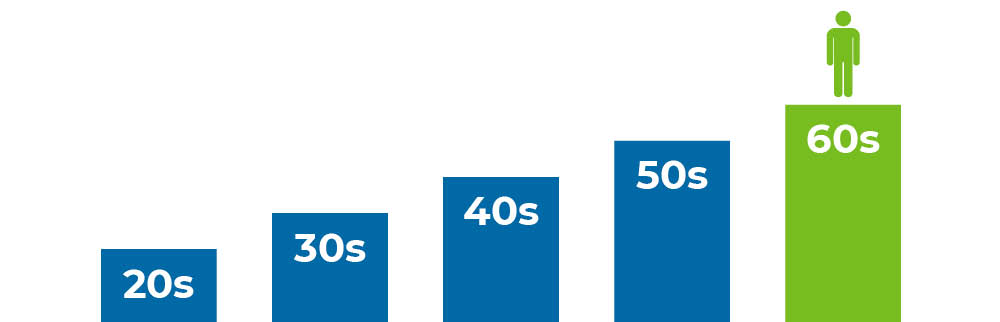

No matter where you are in your career, retirement is likely the beacon driving you forward with hopes for the future. Maybe it seems far away, or maybe it’s just on the horizon—either way, saving for retirement is a good priority to strive for at any stage of life. Discover how to start planning for retirement and how potential strategies to invest for retirement could change as you move through the pivotal decades in your career.

How Much Do I Need For Retirement?

There’s no magic number to shoot for when saving for retirement, but most experts suggest between 60% to 80% of your working income as a target. That means if your current household income is $80,000, somewhere in the range of $48,000 to $64,000 per year would be the sweet spot for retirement. Remember, if you plan to retire in your 60s, retirement could last 20 years or more.

Another important reminder as you prepare for retirement is that everyone’s needs are different, and they will change over time. To help you get a better idea of what might be best for you, take a few minutes each year to think about your needs, which will hopefully become clearer with age. Ask yourself:

- Will you still have big regular expenses, such as a mortgage, car payment or credit card bills?

- What type of lifestyle do you want in retirement: big trips or small vacations? Expensive hobbies or working in a garden? A lot of entertainment or just an occasional night out?

- How about medical expenses: will you need to pay medical insurance until you qualify for Medicare? What are your regular medication costs? Are you planning to buy long-term care coverage to help protect against the unexpected?

Once you have a good idea what your expenses and desired lifestyle will cost, you can tailor the way you invest for retirement accordingly as you age and get closer to your coveted retirement.

How To Start Planning & Saving For Retirement

As you can hopefully see by now, the sooner you start investing in your future, the more financially secure you’ll be in retirement, even if it seems a lifetime away. Think about the magic of compounding, where the money you earn on your investments starts earning money, too. It can really add up. The earlier you start and the more you invest for retirement, the bigger your income source is likely to be when you retire. Once you have an estimate of your expenses and target an age you’d like to retire at, you can compare costs to your expected income and shift your planning accordingly to ensure you stay on track toward your goals.

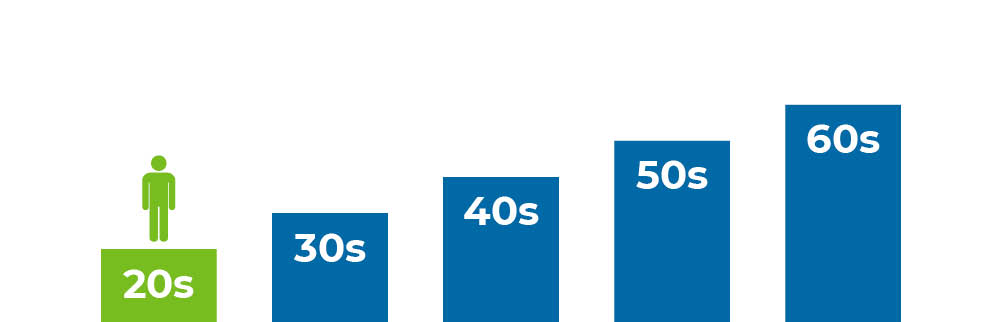

Retirement Planning In Your 20s

As you begin your career, it’s normal to have questions about how to start planning for retirement. Good news: there’s no better time to start saving for retirement than now. If your employer offers a retirement savings plan like a 401(k), make sure you enroll and check out the investment options. Many employers offer some form of matching funds—think FREE money—that will help your savings grow.

If a 401(k) isn’t an option, consider something like a Roth IRA, an individual retirement account. This type of account is an after-tax savings plan, meaning you won’t be taxed on your savings once you start making withdrawals in retirement.

Even if you only set aside a couple thousand dollars each year in a retirement account like a 401(k), 403(b) or an IRA, and that money earns an average of 8% a year, the difference of saving a decade sooner is huge.

Say you save $2,400 a year in your retirement account. After 40 years, the value of your investment will be $648,360. But if you wait to start until 10 years later, you’ll have only $283,522.

So how can you start saving and planning for retirement in your 20s, when finances are probably tight?

Explore Savings Options

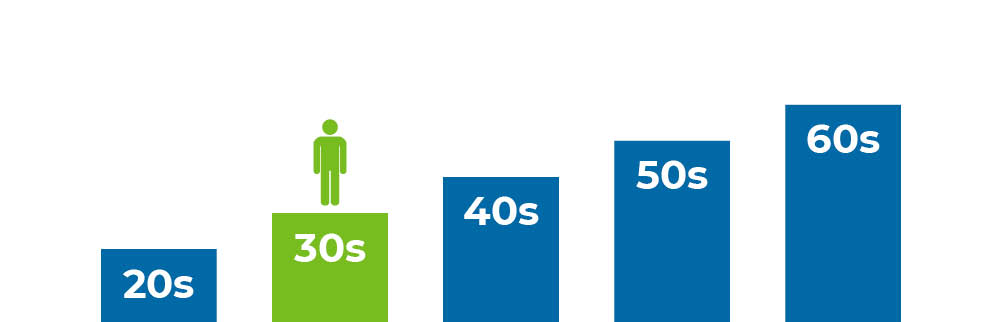

Retirement Planning In Your 30s

By the time many people hit their 30s, they’ve started to establish a career and steadily increase their income. It should be simple to save money for retirement, right?

Not always, but that’s OK. Your 30s can be financially stressful. Many 30-somethings buy a home and take on a monthly mortgage. They start a family. They might be paying off student loans. And they may have credit card debt. The important thing to remember is your long-term goal of being financially fit when you quit working. Don’t put off saving for retirement to free up more financials in the short-term. Experts advise that you watch your spending now so you can be saving for the future.

For example, don’t buy a bigger house than you actually need. Try to pay your credit cards off at the end of every month, or at least as much as you can to keep interest charges down. Contribute as much as you can to your retirement plan and take advantage of employer matching benefits. If it’s possible for you, contributing 10% of your salary toward retirement can be a powerful way to build long-term financial security.

Take the time to study your investment options. While it’s good to have a diverse portfolio, the younger you are the more aggressive you can be as you invest for retirement. Evaluate your options or consult a trusted financial advisor. If you didn’t start contributing to a retirement account in your 20s, don’t waste any more time. Strategic retirement planning in your 30s to put your money to work now will give you a better payout down the road. Remember, any money invested in your 30s can still grow for close to 30 more years, depending on your retirement age!

Discover Savings Investments

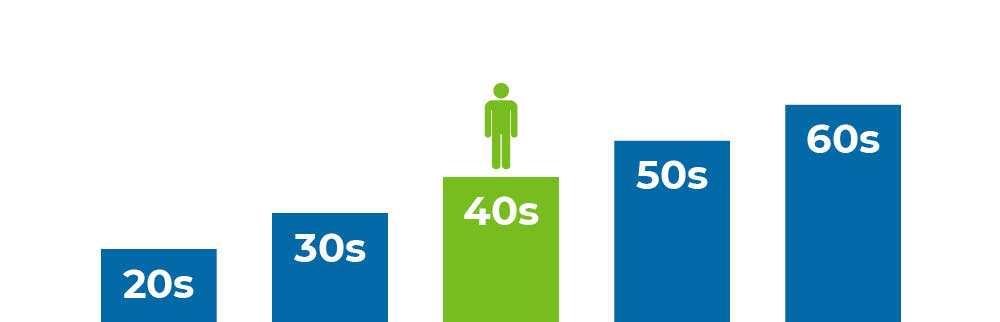

Retirement Planning In Your 40s

In your 40s, you can look at your retirement savings and realize that you either have a healthy start on the future or that it’s time for some emergency action.

If you started contributing to your retirement fund in your 20s or 30s, your money has already been growing. And if you can swing it, your 40s are a good time to take a look at increasing your monthly contribution. But if you’ve waited until now to get started, it’s time to get serious. What can you do?

- If your employer offers a retirement plan, such as a 401(k), you should take advantage of that right away and contribute as much as possible. Maximum personal contribution limits can change annually. To see current limits, go to irs.gov.

- If your budget has room, you should also consider putting money into an IRA each year, which is one more way to save and prepare for retirement.

- Be sure to study your retirement plan investment options and decide on the potential rewards vs. risks you’re comfortable with. A financial advisor can help you find the balance that feels right for you to invest for retirement.

- Pay down debt. The more debt you have, the more you’ll be paying in interest costs, and that’s money that could be going to savings. Setting a goal of having your house paid off before you retire will be a huge help in reducing expenses.

- If you have kids, you’ll need to make some hard decisions about their college funds. While it’s great if you can save for their schooling, some experts say saving and planning for retirement in your 40s is more important.

Discover Growth Opportunities

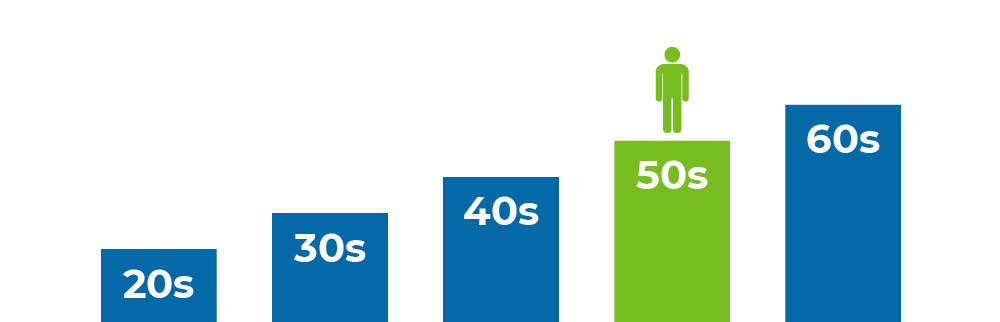

Retirement Planning In Your 50s

If you’re in your 50s and have been slowly saving for retirement, it’s time to shift into high gear. Now is the time to assess what it’s going to take to cross the retirement finish line with enough money to cover your living expenses. Have you saved enough? If not, can you start saving seriously right now? Here are some important things to think about:

- At what age do you plan to retire? Working with target dates and online retirement calculators can help you decide if your target is realistic.

- Are you sure you can afford it? It’s not uncommon to find that working and saving for a few extra years can make a big difference in your post-retirement income.

- What are your plans in retirement? It’s important to remember that you’ll still have expenses once you retire. You will need to buy food, pay bills, have a place to live and cover medical costs. But what about plans for travel or new hobbies? Without new money coming in, you’ll need to have enough saved to keep paying for those expenses.

- Can you reduce your expenses now so you can start saving more? Paying off your bills and cutting back on spending can allow you to put that money into savings. Some experts even say that downsizing your home might be a consideration.

To get yourself in a better position, contribute as much as you can to your work retirement plan. Consider contributing funds to an IRA and maxing that out each year, as well. People over 50 can make catch-up contributions as needed. Know what the maximum and catch-up personal contribution limits are annually to get your savings to a more comfortable place. In the meantime, look into other income sources. Social Security will be a help but probably won’t be enough to cover all of your expenses. You can estimate your annual Social Security income at www.ssa.gov/estimator/. You’ll notice that waiting a few years to start taking Social Security can make a significant difference in how much you will get each month. And if you work for an employer that still offers pensions, be sure to check what your annual pension income will be.

Once you come up with an annual income that you think will work for you, try living on that amount of money for a few months. Can you do it? Active retirement planning in your 50s can either make you feel confident about your plan or can show you what you’ll need to do to get there.

Get More From Your Retirement Savings

Retiring Soon: Retirement Planning In Your 60s

If you’re planning for retirement in your 60s and have been saving throughout your career, you’ve reached the home stretch. But you can still be saving for retirement to ensure you get to the finish line with enough money to cover your post-work lifestyle.

Talk to a financial advisor about your investment mixes to see if they’re right for your needs. While aggressive investments can mean higher payouts, they also can be risky and cause you to lose money at a period of your life that you can’t afford to take a big financial hit. When you invest for retirement, you should feel good about the balance between risk and reward to ensure the investment benefits you.

Try to pay off as many debts as possible so when the time comes to retire you won’t have big expenses such as a mortgage or long-term car payment. If your savings potential is limited, some experts recommend considering selling your home and buying something less expensive. You might even consider working part time once you retire, just to keep some income flowing in.

Be sure to keep your medical expenses in mind, too, thinking about your fixed costs as well as unexpected expenses. Experts advise making sure you’re covered by medical insurance until you’re eligible for Medicare, and some recommend considering taking out long-term care insurance once you hit your 60s to help cover the expenses extended care can bring.

Once you feel prepared for retirement and comfortable to live off of your anticipated income, you can take a deep breath. The long years of saving are behind you, now you just need to be careful about not overspending the money you have. You may have a long retirement ahead of you!

Explore Passive Income In Retirement

It’s Never Too Early To Invest For Retirement—Explore Savings Options with Rivers Edge Bank

Rivers Edge Bank is your partner for the journey as you consider how to start planning for retirement and ultimately put your plan for saving for retirement into action. We provide both short- and long-term savings options to help you reach all of your goals, whether you want a traditional savings account, a short-term certificate of deposit (CD) for savings growth or an IRA for retirement. Contact your local Rivers Edge Bank to learn more about preparing for retirement with a growth-oriented savings account, and explore our options today.

Explore CDs & IRAs