Be Ready For Unexpected Expenses With An Emergency Savings Fund

May 9, 2025

Do you break into a sweat at the thought of replacing a broken refrigerator or covering a major car repair bill? Do constant financial “what ifs” keep you up at night? Life is full of surprises, and not all of them are pleasant. Whether it's a sudden car repair or an unplanned medical bill, unexpected expenses can quickly derail your financial plans. That's where an emergency savings fund comes in: it’s a financial buffer against life's unpredictable moments.

Setting up a savings account to serve as your emergency fund helps you to account for the unexpected. While it might not be the easiest thing to add money to based on everything else you have to spend money on, building an emergency fund saves you from having to take on extra credit card debt or loan payments with interest costs. Rivers Edge Bank can’t predict the future, but we can equip you with the savings tools you need to prep for financial emergencies without putting yourself in a precarious financial position. As your local bank rooted in the community, we prioritize your personal financial stability always and aim to serve you.

The Benefits Of Building An Emergency Fund

Building an emergency savings fund has numerous benefits, from peace of mind and stability to less debt and fewer financial obstacles. But the most basic benefit to remember is that saving a little now will cost you less long-term. With an emergency fund, you can maintain personal financial stability while avoiding debt in challenging times.

Avoid Debt Accumulation

One of the primary benefits of an emergency fund is the ability to sidestep debt. It’s natural to reach for a credit card or consider a loan if you find yourself facing unexpected expenses, but relying on these options often results in high-interest debt that's difficult to pay off. An emergency savings fund allows you to financially prep for emergencies in advance, minimizing the financial strain.

Attain Personal Financial Stability

Financial emergencies can disrupt even the most carefully planned budgets. By having an emergency savings fund, you maintain personal financial stability and peace of mind, ensuring that your long-term financial goals remain unaffected. It's like having insurance: you hope you won't need it, but it's comforting to know it's there. According to a survey by Bankrate, only 41% of Americans can cover a $1,000 emergency without borrowing money—highlighting the need to build an emergency fund as a dedicated savings stash.

Be Financially Prepared For Emergencies

No one can be 100% emotionally prepared for emergencies that arise, but there is peace of mind that comes with knowing you're financially prepared for emergencies as they come. An emergency savings fund reduces stress, allowing you to focus on addressing the issue rather than worrying about how to pay for it. Whether it's a sudden job loss or a medical emergency, you'll have one less thing to worry about.

How Much Should I Have In An Emergency Fund?

Experts vary on how much you need in emergency savings, but the common best practice is to build an emergency fund covering three to six months of your living expenses. Some experts may suggest a target amount like $500, but basing your financial preparation for emergencies on your own financial circumstances is a safer bet. This ensures you have enough to cover the cost of living in the event of an emergency if your income is tied up in unexpected expenses.

For example, $500 might cover a car repair, but a larger amount would help you through a job loss or a medical emergency that could cause you to miss work. It would help you to maintain your personal financial stability as you continue to pay your bills and other expenses. With that said, how do you start an emergency savings fund, and where do you find the money to build it?

How To Start Building An Emergency Fund & Financially Prepare For Emergencies

Rome wasn't built in a day, and neither is a robust emergency savings fund. Start by setting a realistic savings goal based on your income and your lifestyle. A great starting point is saving just enough to be financially prepared to cover minor emergencies. Your long-term goal should be to eventually have enough saved away to cover living expenses if needed, providing a cushion for bigger bumps in the road.

The key is to save while living within your means. It doesn’t work to go into debt while trying to save money for the future. That means that savings goals will be different for everyone, and the timeframe will look different for each household. Be realistic with yourself when setting your savings goals, whether it’s for yourself or your family.

Set Goals For Your Emergency Fund Savings Account

Setting clear and achievable savings goals is crucial for building your emergency fund. Without defined targets, saving can feel overwhelming. Start small, then gradually increase your savings as you become more comfortable. Aim for milestones that keep you motivated and on track. Even if you can only add $5 to start with, it’s a step in the right direction.

If you have the means, start with a minimum of $500 to build your emergency fund savings account. This can help cover unexpected expenses like car trouble or a leaky faucet to keep your daily life and your finances running smoothly. Once you reach this initial goal, use that momentum to work towards saving three to six months’ worth of living expenses. This provides a more substantial buffer against major emergencies, like job loss or health issues, or that surprise invitation to your cousin’s wedding across the country.

Maintain Personal Financial Stability With A Budget

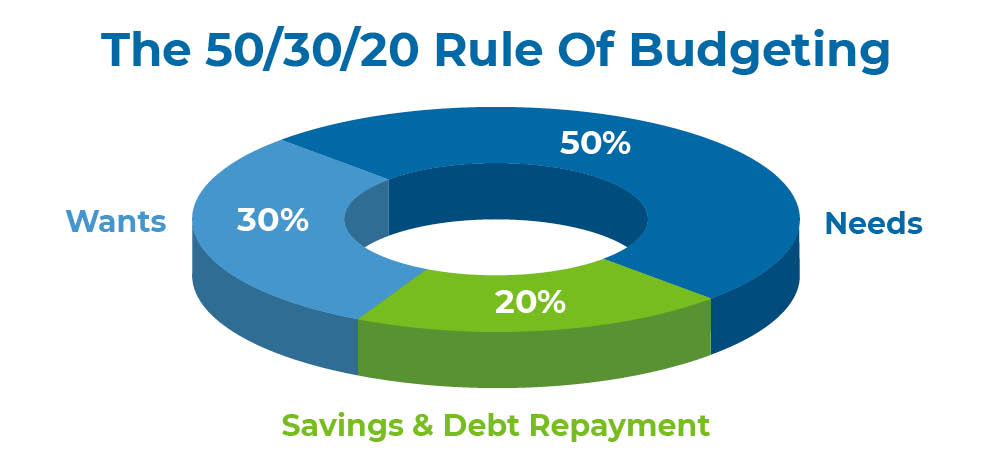

There are plenty of tools and strategies to help you reach your savings goals. Budgeting apps and online resources can help you track your spending and identify areas where you can cut back. Meanwhile, you can protect your personal financial stability by trimming non-essential expenses and potentially increasing your income with a side hustle or extra work hours if it will help you feel more confident. Stick to a popular budget planning strategy like the 50/30/20 rule, which breaks down like this:

- 50% of your income goes to needs (housing, food, utilities)

- 30% goes to wants (entertainment, dining out)

- 20% is dedicated to savings and debt repayment

This approach allows you to allocate funds systematically, making sure your emergency savings fund grows steadily. One of the best ways to build your emergency fund is to make saving automatic. Set up automatic transfers from your checking to your savings account. That way, you don’t have to think about it; the money will simply move to your savings each month.

Regularly Track Your Emergency Savings Fund’s Progress

Building an emergency fund takes commitment, and there will be bumps along the road. Unexpected expenses can test your resolve, but remember you’re working toward long-term savings goals. Track your progress to stay motivated and celebrate your milestones. Seeing your savings grow can be a powerful motivator to keep going.

Only dip into your emergency fund savings account for real emergencies! Setting clear boundaries around what constitutes an emergency can prevent impulse spending from derailing your savings goals. For example, new brakes for your car would certainly qualify, while updating to the latest smartphone probably shouldn’t. If you do need to dip into your emergency savings fund, make it a priority to replenish it as soon as possible. This may require some extra tight budgeting for a little bit, but it’ll be worth it to help ensure that you're financially prepared for the next emergency.

And as you might imagine, choosing the right savings account is essential for maximizing your fund's growth. Look for a high-yield savings account that offers competitive interest rates. This can significantly impact how much your emergency fund grows over time, making your savings work harder for you. A little extra interest adds up over time!

Choosing The Right Savings Account For Your Emergency Fund

When it comes to choosing which savings account is right for your emergency fund, you have a number of factors to consider. The primary consideration is accessibility, as you’ll need to be able to get to your funds, but interest rates and account fees are also important to note. Opt for a high-yield savings account that offers a competitive interest rate to maximize your savings, and avoid accounts with excessive fees that can erode your savings. Before you open a savings account, be sure the institution offers FDIC insurance and the account allows for quick withdrawals when needed. A few options to explore include:

- High-Yield Elite Money Market Savings Accounts - A high-yield savings account is an excellent option for your emergency savings fund. These accounts offer competitive interest rates, allowing your money to grow over time. Look for accounts with low or no fees and easy accessibility, like Rivers Edge Bank’s Elite Money Market Savings solution.

- Simply Savings Online Savings Accounts - Online savings accounts like Rivers Edge Bank’s Simply Savings solution are convenient and easily accessible, making them a popular choice for emergency funds. Plus, a Simply Savings account has no service fees and doesn’t require a minimum balance, making it ideal for long-term savings.

- Certificates Of Deposit (CDs) - While not as liquid as savings accounts, certificates of deposit (CDs) can be part of your emergency fund strategy. CDs offer higher interest rates but require a longer commitment. Consider laddering CDs to balance accessibility with growth potential.

Discover How Rivers Edge Bank Can Help You Achieve Personal Financial Stability

Building an emergency savings fund is an essential step toward achieving personal financial stability. It not only provides a safety net for unexpected expenses but also fosters a sense of peace and security. By setting achievable savings goals, utilizing helpful tools and strategies and maintaining your fund for the long term, you can confidently tackle any financial challenge life throws your way. Start saving today and grow your emergency fund with a savings account at Rivers Edge Bank. The sooner you start saving, the more prepared you’ll be for whatever life brings, so get in touch with your local Rivers Edge Bank and let our team know how we can help you reach your goals!

Explore Our Savings Options