What to Expect When Buying a House: Your Home Mortgage Road Map

Buying a home is an exciting time, but most homeowners will attest there is one hurdle to get past before it’s truly time to celebrate: the loan mortgage process. We get it! Appraisals. Title work. Verifications. Tax returns. Credit history. So. Many. Acronyms. Whether buying your first home or seeking refinancing solutions, navigating home mortgages can be a daunting undertaking full of twists and turns.

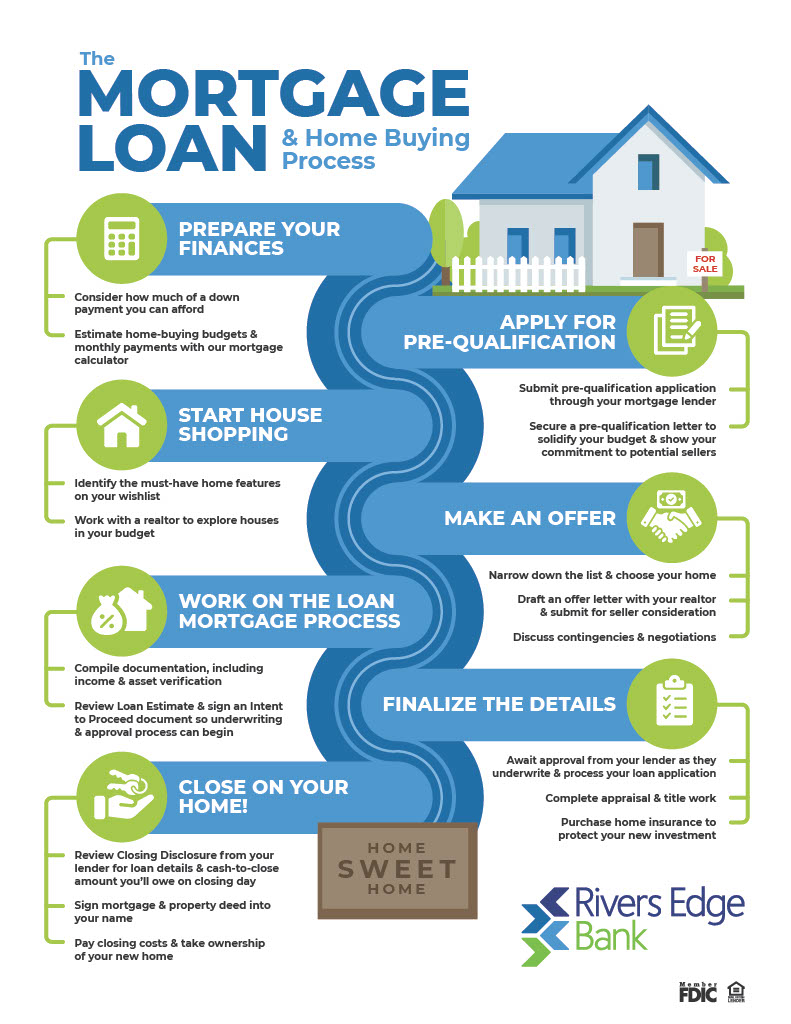

But the path to finding home sweet home doesn’t have to be a bumpy one. Rivers Edge Bank has supported countless homeowners through the home buying process right here in our local communities. Along with serving our small towns as reliable mortgage lenders, we aim to be a resource to help guide homeowners through applying for a home loan and landing the home of their dreams. Our home mortgage roadmap walks you step by step through what to expect when buying a house so you’re equipped with everything you need to feel confident about your purchase. After all, there’s no place like home!

How to Purchase a Home: Details on the Home Buying Process

- Understand your financial situation.

- Consult your home mortgage lenders and apply for pre-qualification.

- Find a real estate agent and start house hunting.

- Make an offer.

- Complete the final phases of the loan mortgage process.

- Finalize the details.

- Officially close on your new home.

The first step you should take before applying for a home loan is evaluating your financial situation. For example, take stock of your expenses and your savings to get an idea of what you can reasonably afford to spend on a home. Along with your planned expenses, it’s wise to have enough money set aside to cover emergencies that may arise for maintaining and repairing your home as the owner. Keep in mind you’ll also owe money upfront for a down payment and potential closing costs, which affect the regular mortgage payments you’ll be responsible for throughout the duration of the loan.

How much of a mortgage can I afford?

Use Rivers Edge Bank’s mortgage calculator to determine how much you can reasonably afford to spend on a home mortgage. Play around with your budget and see how various down payment amounts impact what you owe on your mortgage weekly or monthly depending on your desired schedule. While 20 percent used to be expected as a down payment, homebuyers today enjoy more flexibility and many opt to put less down. However, you’ll see paying less upfront leads to larger monthly mortgage bills. Those who don’t put 20 percent down typically must pay for private mortgage insurance or loan guarantee fees, depending on the mortgage type. Be sure to weigh what makes the most sense for you and your family long-term.

Calculate Your Loan Payment

|

Another number you should consider before buying your first home is your credit score. Home mortgages charge you for both your principal balance and interest accrued on your loan. Those with higher credit scores are often rewarded with lower interest rates, meaning you’ll pay less throughout the lifespan of your loan. Try inputting different interest rates into the calculator and see how it impacts your payoff amounts.

One of the most critical steps of applying for a home loan is securing pre-qualification from your mortgage lender. But before you jump feet first into the loan mortgage process, Rivers Edge Bank is here to discuss various home loan options to help you land on your feet. We offer multiple home mortgage solutions to provide families and first-time home buyers the flexibility you need to take this pivotal financial step toward your future. Once you’ve selected the loan that will best serve your needs, you’re ready to request pre-qualification from your Rivers Edge Bank mortgage lenders.

How to Get Pre-Qualified for a Mortgage

To kick off the loan mortgage process, be prepared to complete a physical application including pertinent information like your employment history, current income and planned down payment amount. We’ll also verify your credit history through a routine credit check, which is standard to qualify for most loans. Just like you spent time evaluating your finances leading up to this large purchase, our trusted mortgage team at Rivers Edge also will assess your current financials to help set you up for success with a pre-qualification letter.

Once you’re feeling confident about moving forward and have completed your application for a home loan, your mortgage lender will process your application and work to get you pre-qualified for a home purchase. You may receive a letter of pre-qualification to provide sellers, which helps demonstrate your commitment to the home buying process and shows you have spoken with a lender to prepare your financing options. This is also helpful to solidify your house hunting budget and tailor your search to homes within your range because you know exactly how much money you’re able to borrow.

Pre-qualification letters are typically only valid for 60 to 90 days, so you may have to reapply. When you’re serious about buying your first home, getting pre-qualified is the best way to set things in motion. Realtors like to work with homebuyers who have been pre-qualified because it streamlines your ability to submit an offer and close on a home.

Along with your reliable mortgage lender, another essential member of your home buying team will be your realtor. We help you determine what you can afford in a home, while your real estate agent applies their practical expertise to the market to find you a home within your budget. If you choose to work with a realtor, it’s important you find someone you can trust to have your best interests in mind. Be sure to fill them in on your price range as well as any other criteria you’re looking for in a home, like location, size or specific features on your wish list.

If you’re not ready to work with a realtor or would rather get an idea of what’s on the market yourself first, it can be fun to shop around to see what’s out there. The benefit of working with a realtor is they’ll be the first to know when homes are available so you can act fast to view a home and potentially put an offer down.

A good realtor will help you tailor your expectations for what to expect when buying a house in your price range but will also do their best to check as many boxes off your list as possible. To help your agent out, narrow your wish list down to essentials you can’t live without versus ideal features you’d like to have but aren’t dealbreakers. Buying your first home is an exciting time, and you’ll soon be able to make it your own.

To ensure you explore all the options available to you, shop around and tour several homes before putting in an offer. This allows you to get the full picture of what’s out there in your price range so you find the house you can truly imagine a future in. Work closely with your realtor to draft an offer including what you’re willing to pay and any contingencies your offer is dependent on (such as the house passing an inspection before you move in). Your realtor will know the ins and outs of putting forward a winning offer in the current market and will help you fight for the best deal even if the seller rejects your offer or begins negotiations. Once your offer is accepted, congratulations, you’ve completed the most important stage of the home buying process! Allow yourself to celebrate, but don’t forget to take care of a few final items to seal the deal and officially take ownership of your home.

After your offer is accepted, the only thing standing between you and homeownership is the paperwork required to complete the loan mortgage process. And Rivers Edge Bank is here to help you reach the finish line. For our part, your mortgage lender will work with the rest of our mortgage team to put together a loan estimate for you. This document highlights your loan details such as loan amount, loan term and estimated payment. The document will also provide you an estimated amount for closing costs per the loan product for which you applied. You will also receive other disclosures detailing your rights and resources available during the loan process.

After you review your estimate and preliminary disclosures, we ask that you inform your lender if you intend to proceed with your loan via a signed Intent to Proceed document or other means of communication. Once you confirm your intent, the lender and mortgage team will get to work underwriting and processing your loan to move you closer to making your mortgage loan a reality! If you were previously pre-qualified by our mortgage lenders, this is the stage where we verify the information you submitted in your application for a home loan.

|

To complete the process, we’ll request necessary documentation, including, but not limited to:

- W-2 forms from at least the two years prior

- Pay stubs from the last 30 to 60 days

- Proof of other sources of income and/or documentation of gift money received

- Federal income tax returns from the past two years

- Recent bank statements

- Valid ID and Social Security number

|

Your paperwork is submitted, and you’ve reached the home stretch! Now is the time you prepare to take possession of your new home. We recommend scheduling a home inspection prior to your closing date to protect your best interests in the event there are any concerns or damages found in the home. If your offer included inspection contingencies, the previous homeowner may be responsible for making or paying for these repairs before the home title is signed over to you. You can work with your realtor to negotiate with the seller and potentially ask for a credit to address repairs that can’t take place until after you close on the home.

As your mortgage lenders, Rivers Edge Bank requests a home appraisal be performed by a state-licensed appraiser. The appraiser will conduct an on-site inspection to confirm the value of the property. In doing so, we ensure you are receiving a fair price and aren’t being overcharged. When you take out an insurance policy on the home, the appraisal valuation can help determine how much coverage you need depending on the cost to replace the home in the event of an emergency or disaster.

While you’re securing the future of your home, Rivers Edge Bank is hard at work underwriting your home mortgage to finalize the home buying process.

How long does the underwriting process take for a mortgage?

It typically takes a few days for mortgage lenders to process loan applications, though it can be up to several weeks if your documentation isn’t submitted in a timely fashion. Issues like discrepancies discovered during the home appraisal or problems with the buyer’s documentation delay the process. The timeline for securing an appraisal fluctuates, which may also contribute to longer waiting periods as all the necessary steps are completed.

|

To help us help you claim ownership of your new home as quickly as possible, we appreciate timely submission of your proof of income and other documentation to secure the loan. We work diligently to verify all your information quickly, paying special attention to considerations like your credit history, ability to pay back your loan and any collateral leveraged toward the home. A title commitment is ordered to make sure the title to the home can be conveyed to you as the new owner and/or a mortgage can be placed on the property by Rivers Edge as the lender. Sometimes it may involve further inquiries into past home transactions, or a survey may need to be ordered.

Ultimately, we want our community members to plant roots in the small towns we call home. If your home loan application is insufficient, we’ll let you know what we need to move forward and discuss other options to help you toward your home ownership goals if needed. Otherwise, if we have everything, we’ll move into the closing process and congratulate you on your new home.

Once all your information has been verified and the appraisal and title work come back sufficient, we’ll prepare a closing disclosure for your review. The disclosure will detail your final loan terms like loan amount, interest rate and payment amount, as well as a breakdown of how much money you may need to bring to your closing appointment. It will also list all the closing costs that occurred during the process.

Closings for home purchases typically occur with a settlement agent at a title company. You will need to bring up to two forms of identification with you as well as the cash-to-close amount disclosed to you in your closing disclosure. These funds typically need to be in the form of a cashier’s check. Loans not involving the transfer of a property can usually be closed in-house by your lender. You can set up a closing time with your mortgage lender and take care of signing documents right at Rivers Edge Bank. On closing day, you’ll sign the mortgage and property deed, and the home officially belongs to you.

Closing day logistics can be overwhelming, so we will make sure to touch base with you before closing. Our local mortgage lenders make it a priority to attend closings to make sure everything goes smoothly and to address any questions that may arise. We are in your corner to make sure the loan mortgage process is as easy as possible. Your realtor will also be a helpful resource during the closing process. We empower you to move forward confidently knowing there’s a whole team behind you that has your back.

You’ve Checked Buying Your First Home Off Your List! What’s Next?

Once you’re settled into your new home, it will come time for you to start making your mortgage payments on your agreed-upon schedule. You should receive your first mortgage bill two to three weeks after moving into your home, depending on your closing date. Typically, mortgage payments are due on the first day of the month after you’ve owned your home for a full month. For example, if you purchase a home in mid-January, your first payment wouldn’t be due until March 1.

Some of our loan products have payments that can be made directly to Rivers Edge Bank while others may have a different mortgage servicer where payments should be submitted. Your lender will provide you with that information at closing so you are aware of where your payments should be sent.

As part of your loan process, you may establish an escrow account for your homeowner’s insurance, property taxes, flood insurance and/or private mortgage insurance. These escrow accounts collect part of your monthly payment so any of these items due from you can be made on your behalf. Each year your mortgage servicer will provide you an escrow analysis of all your ins and outs and what your projected escrow payments will be for the upcoming year.

Rivers Edge Bank’s Mortgage Lenders Are Here to Help Beyond the Loan Mortgage Process

Allow Rivers Edge Bank to be the first to welcome you to the community we call home! Our team is readily available to be a resource for you as you navigate the home buying and loan mortgage processes and beyond. We are your trusted mortgage lenders, but more than that, we are your partner on the journey. From finding a house to making it a home, we’re always cheering you on from the sidelines and eager to support you with a number of mortgage and refinancing solutions. Contact your local Rivers Edge Bank to see how we can assist you in buying your first home or finding a more favorable mortgage for your home.